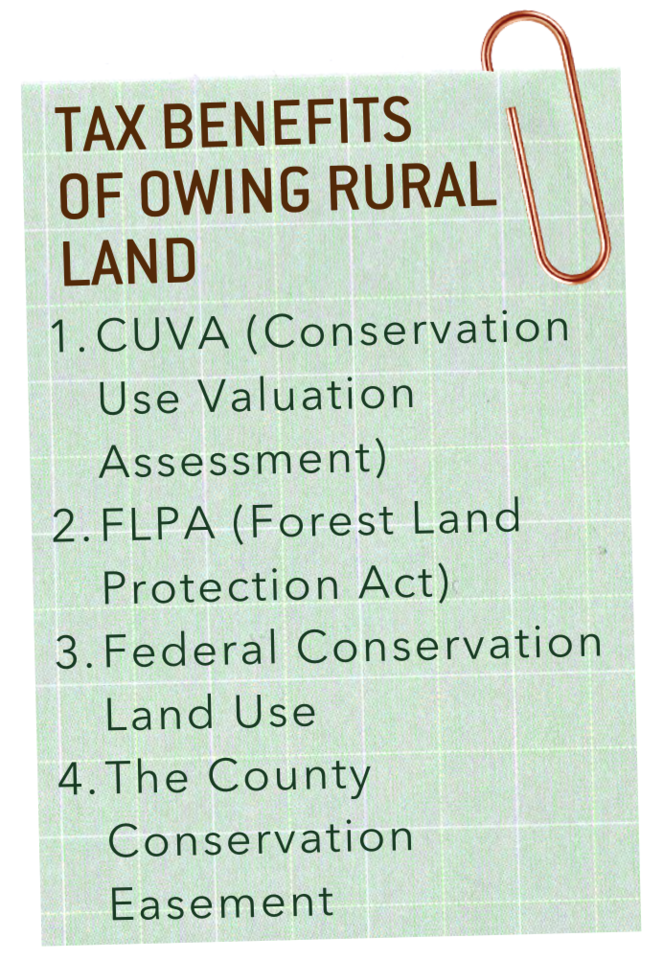

Tax Benefits of Owning Rural Land

There are a number of tax exemptions and benefits available to rural landowners. It comes down to understanding the codes in your specific area.

Along with all the fresh air and wide-open spaces, owning rural property can come with financial perks in the form of tax exemptions and benefits.

Because of the complexity of tax codes and how much they vary by region, it can be confusing for landowners to work out which exemptions and benefits are available to them.

For the best understanding of tax exemptions on your specific piece of rural property, talk to your land agent and seek out a knowledgeable tax professional in your area.

But to get started here are a few of the tax benefits of owning rural land in Georgia!

Ryker Carter -

Founder, Co-Owner, Land Sales Expert

Ryker Carter -

Founder, Co-Owner, Land Sales Expert

28 Comments

Leave a Comment